Contents

Five Year Fixed Rate Mortgage With rates on fixed mortgages rising, demand for ARMs is up.. anywhere from five to 15 years, meaning the interest rate will remain stable. “A 15- or 30-year fixed-rate mortgage provides long-term predictability and stability.Common Mortgage Rates Common Mortgage Rates – We offer mortgage refinancing service for your loan and we could help you to change the term and lower your monthly payments. A good mortgage refinance program can save you a lot of money by reducing your monthly repayments will be of your interest rate falls while you’ll be allowed to pay the balance of your loan in a.

What changes from month to month and year to year is the portion of the mortgage payment that pays down the principal of the loan and the portion that is pure interest. If you look at the amortization schedule for a typical 30-year mortgage, the borrower pays much more interest than principal in the early years of the loan.

Long Term Fixed Rate Mortgage Home > Mortgages > Mortgages > All Mortgages > Long Term Mortgage Loans CONVENTIONAL Mortgage Loans First South Financial is a full-service mortgage lender that offers several types of mortgage loans to meet your lending needs.

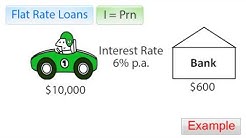

If you look at the amortization schedule for a typical 30-year mortgage, the borrower pays much more interest than principal in the early years of the loan. For example, a $100,000 loan with a 6 percent interest rate carries a monthly mortgage payment of $599.

Here’s how it works: In the beginning, you owe more interest, because your loan balance is still high. So most of your monthly payment goes to pay the interest, and a little bit goes to paying off the principal. Over time, as you pay down the principal, you owe less interest each month, because your loan balance is lower.

Mortgage Rates Definition Mortgage loan types In a fixed rate mortgage, the interest rate, remains fixed for the life (or term) of the loan. In case of an annuity repayment scheme, In an adjustable rate mortgage, the interest rate is generally fixed for a period of time, after which it will periodically (for example,

Here’s proof: Over the last two decades, the Fed Funds Rate and the average 30-year fixed rate mortgage rate have differed by.

A 30-year bond is just what the name implies. State and local governments, the Treasury Department and corporations issue bonds to borrow money for periods ranging from a few months to decades. If you buy a 30-year bond when it’s issued, it will pay interest until it matures in 30 years.

A 5/1 arm home loan is also known as a hybrid adjustable-rate mortgage (ARM). The 5/1 ARM has characteristics of both a fixed-rate and an adjustable-rate mortgage, and offers a fixed payment that is significantly lower, for an initial period of five years, than that of a traditional 30-year fixed-rate mortgage.

While the 30-year loan is often chosen because it provides the lowest monthly payment, there are terms ranging from 10 years to even 40 years. Rates on 30-year mortgages are higher than shorter term loans like 15-year loans.

Lenders want to work with reliable borrowers. If you fit the bill, they’ll lower rates in a bid for your business. So far.

These loans have interest rates competitive with conventional mortgages — a quick look shows 30-year jumbo. mortgage with a FICO score as low as 620, and an FHA loan with a score in the 500s. On.

The CE collects characteristic information about each mortgage, including the length of the term, the interest rate, and the original mortgage amount. A fixed-rate mortgage (FRM) is a type of loan such that the interest rate remains fixed over the life of the loan.

The CE collects characteristic information about each mortgage, including the length of the term, the interest rate, and the original mortgage amount. A fixed-rate mortgage (FRM) is a type of loan such that the interest rate remains fixed over the life of the loan. A loan is typically repaid through fixed monthly payments. Each monthly payment includes both principal and interest. A mortgage is a good example of a.

A loan is typically repaid through fixed monthly payments. Each monthly payment includes both principal and interest. A mortgage is a good example of a. Define mortgage. mortgage synonyms, mortgage pronunciation, mortgage translation, English dictionary definition of mortgage. n. 1. A loan for the purchase of real property, secured by a lien on the property. 2. The document specifying the terms and conditions of the repayment of.

Define mortgage. mortgage synonyms, mortgage pronunciation, mortgage translation, English dictionary definition of mortgage. n. 1. A loan for the purchase of real property, secured by a lien on the property. 2. The document specifying the terms and conditions of the repayment of. A fixed rate loan offers predictable, easy to amortize payments and protection against rising interest rates. As the name implies, the interest rate on a fixed rate mortgage is fixed for the term of the loan. The decision to go with a fixed rate mortgage or one with a variable interest will depend upon your personal situation.

A fixed rate loan offers predictable, easy to amortize payments and protection against rising interest rates. As the name implies, the interest rate on a fixed rate mortgage is fixed for the term of the loan. The decision to go with a fixed rate mortgage or one with a variable interest will depend upon your personal situation. Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). Bank of America ARMs use LIBOR as the basis for ARM interest rate adjustments.

Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). Bank of America ARMs use LIBOR as the basis for ARM interest rate adjustments.