Contents

A. Adjustable Rate Loans (ARHL) and Combination Rate Home Loan (“CRHL”) during the period of applicability of the Variable Rate of interest: a) For Individual Borrowers: For all loans sanctioned only to individual borrowers, no prepayment charges shall be payable on account of part or full prepayments made through any sources.

The flat fee mortgage allows the consumer to pay a flat rate commission to a loan officer or mortgage broker A no-cost mortgage refinancing option that can save you time and money. Want to refinance your mortgage for a lower rate, different loan terms, or to get cash out?

House Loan Terms SBI has personalised offers on home loans. Calculate the EMI’s and choose the most suitable product for you and your needs. sbi home loans calculator, check your instalments here.

Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). Bank of America ARMs use LIBOR as the basis for ARM interest rate adjustments.

Also called a variable-rate mortgage, an adjustable-rate mortgage has an interest rate that may change periodically during the life of the loan in accordance with changes in an index such as the U.S. Prime Rate or the London Interbank Offered Rate (LIBOR). Bank of America ARMs use LIBOR as the basis for ARM interest rate adjustments.

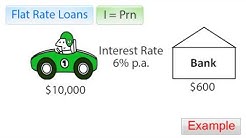

Mortgage rates were flat-to-slightly-higher today, depending on the lender and the time of day. Why would the time of day matter? mortgage rates are based on prices and yields in the bond market.. flat interest rate: Interest charged on the loan without taking into consideration that periodic payments reduce the amount loaned.

A flat rate is a price rather than a percentage and is typically applied where variable sales volume is concerned. MCLEAN, Va., Aug. 01, 2019 (GLOBE NEWSWIRE) – Freddie Mac (FMCC) today released the results of its Primary Mortgage Market Survey (PMMS ), showing that the 30-year fixed-rate mortgage rate sat at.

· An interest rate is the flat rate that you’ll pay on the mortgage. On the other hand, an APR includes a number of other costs you’ll incur, such as fees, closing costs, origination fees, points and insurance. Overview of Bank of America Mortgages.

“Growing expectations that mortgage rates will remain flat or decline are reflected in the HPSI’s latest reading, which is now at a survey high even though other indicators of economic and housing.

Constant Rate Loan Definition Measuring Prepayment Speeds. The standard measure of prepayment speeds is the "constant prepayment rate" or CPR. The most commonly used CPRs are 1-month CPRs (or CPR1 in Eikon) and are based on a single month’s experience.

NEW YORK – JPMorgan Chase & Co. says profits grew by 8% in the third quarter compared with a year earlier, helped partly by.

Mortgages. Whether you're buying a new home or refinancing your current mortgage to a lower rate, PFCU's Flat Fee Mortgage Program has got you covered.

Principal Fixed Account A fixed deferred annuity is an insurance contract you purchase to grow your savings safely, and create guaranteed income when you need it. fixed annuities offer: Guaranteed growth with set interest rates that ensure your money isn’t affected by market volatility