Contents

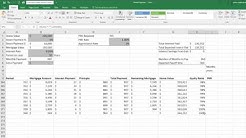

Adjustable-Rate Mortgage: The initial payment on a 30-year $200,000 5-year Adjustable-Rate Loan at 3.75% and 74.91% loan-to-value (LTV) is $926.24 with 2.625 points due at closing. The Annual Percentage Rate (APR) is 4.39%. After the initial 5 years, the principal and interest payment is $975.97.

Loan recasts are allowed on conventional, conforming Fannie Mae and freddie mac loans, but not on FHA mortgage loans or VA.

Mortgage rates held steady this past week after hitting a new low for 2019 just a few weeks ago. Average 30-year mortgage rates today increased to 3.65 percent last week, up from the prior week’s average rate of 3.64 percent. Back in early September, average 30-year mortgage rates fell to a fresh low of 3.49 percent.

Definition Of Private Mortgage Insurance fha or conventional loan better · FHA and conventional loans also have different mortgage insurance guidelines. You will have to pay insurance every month if you are unable to put 20% down. FHA Loans. You pay two types of mortgage insurance on FHA loans. First, you pay upfront mortgage insurance. You pay this at the closing. Today, it equals 1.75% of the loan amount.Lender's may also require borrower's to buy mortgage insurance (called private mortgage insurance, or PMI) when the borrower's down payment is less than.

Estimate the rates and payments of a new mortgage, refinance, or home equity line of credit using today’s mortgage rates with the Wells Fargo mortgage rate calculator.

To calculate your estimated monthly payments on a fixed-rate mortgage, enter the home cost in our fixed-rate mortgage calculator. What are the fixed mortgage rates today? See current fixed-rate mortgages for a variety of conventional mortgages, and learn more about rate assumptions and annual percentage rates (APRs). See today’s fixed mortgage.

refinance fha to conventional loan FHA loans also have some nice features that conventional do not. FHA loans are eligible for "streamline refinances" – which is a cheaper and quicker way to refinance your loan in a low interest rate period. FHA loans are normally priced lower than comparable conventional loans.Refinance Mortgage Comparison Loan Rate Comparison Compare The Market Pty Ltd acn 117 323 378 (ctm) is a corporate authorised representative of Australian finance group limited acn 066 385 822 (Australian Credit Licence 389097 (AFG).This site compares home loan products from participating brands, being Adelaide Bank, AFG Home Loans, AMP.What to know about refinance rates and refinancing a mortgage. What is a mortgage refinance? A mortgage refinance allows borrowers to pay off and replace an existing mortgage with a.

Mortgage interest rates vs. APR. The Annual Percentage Rate (APR) represents the true yearly cost of your loan. It includes the actual interest you pay to the lender, plus any fees or costs. That’s why a mortgage APR is typically higher than the interest rate – and why it’s such an important number when comparing loan offers.

conventional or fha loan better FHA loans are best for borrowers who have lower credit than it takes to qualify for a conventional loan. Still, those with higher credit might choose it for other reasons. Conventional : This is an "open market" loan type. In other words, the loan is not directly backed by the government.

View our FHA loan rate table to see current, up-to-date interest rates by our top-rated FHA lenders. To get the best rate on your FHA loan, there are a few things you can do to ensure you’re paying the least amount of money in interest possible. First, improve your credit score. While you don’t.

![]() GOLD SPEED showed plenty in bumpers and looks the type to make an impact in this sphere. judex lefou sets the standard, while.

GOLD SPEED showed plenty in bumpers and looks the type to make an impact in this sphere. judex lefou sets the standard, while.

Crypto holders can earn interest by transferring their coins to their Celsius Wallet and borrow USD against their crypto collateral at interest rates as low as 4.95% APR. Download the Celsius.

COLUMBUS, Ohio–(BUSINESS WIRE)–The U.S. Department of Housing and Urban Development (HUD) recently released production data for its FHA 232

COLUMBUS, Ohio–(BUSINESS WIRE)–The U.S. Department of Housing and Urban Development (HUD) recently released production data for its FHA 232