Contents

David Chee answers the FAQ: How do reverse mortgage interest rates work? Learn about that and get started with your California reverse mortgage today.

Fixed interest rates are only available for lump-sum reverse mortgages, which come with their own set of potential problems. If you opt for monthly payouts or a line of credit, your interest rate will be adjustable, which means it can potentially rise over time.

Reverse Mortgage Of Texas Reverse mortgage funding llc (RMF), a wholly owned subsidiary of Reverse Mortgage Investment Trust Inc., is an independent HECM lender. HECMs-also known as reverse mortgages-are all we do. We don’t have competing corporate priorities or multiple lines of business.

Reverse mortgages aren't for everyone, but they can give you more. officer can earn a higher commission by selling you a higher interest rate.

Texas Reverse Mortgages How Does A Hecm Loan Work How to Educate Financial Advisors About the New Reverse Mortgage – But recent changes to the product that lower principal limits and change mortgage premiums have some worried that the HECM has lost its appeal among financial advisors. While some retirement income.Experience matters in the Reverse Mortgage business and with a combined experience of over 20 years helping texas homeowners with reverse mortgages. "We do reverse mortgage loans others can’t". Lone Star Reverse Mortgage, Inc. serves the entire state of texas including dallas, Fort Worth, Austin, Houston, San Antonio and all regions.

Reverse mortgage Adjustable-rates, or arms: interest rate: annual adjustable with a periodical change of up to 2% with a lifetime cap rate of 5% over the start rate. Monthly adjustable option comes with a no periodical caps and a lifetime cap rate of 10% over the start rate. Generally, interest rates are slightly lower than with fixed-rate.

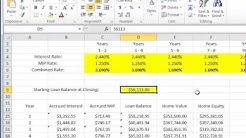

![]() Reverse Mortgage Rates – Average HECM Rates Below you’ll find the latest average interest rates for Home Equity Conversion Mortgages, the most common type of reverse mortgage. HECM interest rates can vary depending upon purpose of the loan and whether the homeowner selects a fixed or variable rate product.

Reverse Mortgage Rates – Average HECM Rates Below you’ll find the latest average interest rates for Home Equity Conversion Mortgages, the most common type of reverse mortgage. HECM interest rates can vary depending upon purpose of the loan and whether the homeowner selects a fixed or variable rate product.

Could you afford that? Let’s say you want to buy that mid-priced home using a 30-year fixed-rate mortgage at this week’s.

For adjustable-rate reverse mortgages, the IIR can change with program limits up to a lifetime interest rate cap. Expected interest rate (EIR) [ edit ] The expected interest rate, or EIR, is used mainly for calculation purposes to determine how much a reverse mortgage borrower qualifies for based on the value of the home (up to the maximum lending limit of $726,525 ) and age of the youngest borrower.

Lowest Cost Reverse Mortgage Reverse mortgage – Wikipedia – The cost of getting a reverse mortgage depends on the particular reverse mortgage program the borrower acquires. These costs are frequently rolled into the loan itself and therefore compound with the principal. Typical costs for the reverse mortgage include: an application fee (establishment fee) = between $0 and $950

Interest Rates On Reverse Mortgages – If you are looking for lower mortgage payments, then mortgage refinance can help. See if you can lower your payment today.

With reverse mortgage loans, a fixed interest rate will usually result in a smaller total loan amount, however the interest rate will not change and an accurate projection can be made of the total cost of the loan.

At the current average rate, you’ll pay $463.68 per month in principal and interest for every $100,000 you borrow. That’s up.

Bankrate’s rate table compares today’s home mortgage & refinance rates. Compare lender APR’s and find ARM or fixed rate mortgages & more.

Bankrate’s rate table compares today’s home mortgage & refinance rates. Compare lender APR’s and find ARM or fixed rate mortgages & more.