Contents

Use this page to look up the conforming and FHA loan limits in every county. Any mortgage for more than the county’s loan limit is a jumbo loan. A mortgage for more than the conforming limit set by.

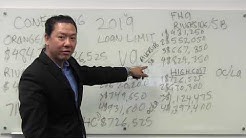

FHFA raises conforming mortgage loan limit to $424,100 – "Today’s conforming loan limit increase is a much-needed recognition of rising home prices in high-cost markets, and a help to first-time and lower-income borrowers looking to utilize an FHA mortgage, FHA Mortgage Vs Conforming Mortgage : A Cheat Sheet With so much difference between the FHA and conforming 30-year fixed rate.

Jumbo loans typically require a higher credit score & a larger downpayment than conforming loans. It is also quite common for jumbo loans to charge slightly higher interest rates. The conforming loan limits also apply to other government-backed housing programs. The FHA set the floor at $314,827 while setting their ceiling at $726,525.

A non conforming loan is a mortgage loan that exceeds the conforming loan limits. Non conforming loans are funded by lenders or investors. Because they are not easily sold to Fannie or Freddie, they typically are more difficult to. Another edition of mortgage match-ups: "FHA vs. conventional loan."

Jumbo Loan Limit 2017 A loan is considered jumbo if the amount of the mortgage exceeds loan-servicing limits set by Fannie Mae and Freddie Mac – currently $484,350 for a single-family home in all states (except Hawaii and Alaska and a few federally designated high-cost markets, where the limit is $726,525).

View the current FHA and conforming loan limits for all counties in Colorado. Each Colorado county conforming mortgage loan limit is displayed.. Louisiana conforming and FHA loan limits by county.

Other types of conventional loans-that are not conforming-include jumbo loans, portfolio loans, and subprime loans. FHA Loans. A FHA loan is a loan insured by the federal housing administration (fha). If you default on the loan and your house isn’t worth enough to fully repay the debt through a foreclosure sale, the FHA will compensate the.

Other types of conventional loans-that are not conforming-include jumbo loans, portfolio loans, and subprime loans. FHA Loans. A FHA loan is a loan insured by the federal housing administration (fha). If you default on the loan and your house isn’t worth enough to fully repay the debt through a foreclosure sale, the FHA will compensate the.

Non Qualifying Home Loans The non-QM opportunity. The Consumer Financial protection bureau produced a list of requirements for a mortgage to be considered a qualified mortgage (or QM). On January 1, the new QM rules took.

FHA Mortgage Vs Conforming Mortgage : A Cheat Sheet With so much difference between the FHA and conforming 30-year fixed rate mortgage, there’s no set playbook for choosing the best mortgage.

Non-conforming loans usually have a much higher interest rate than conforming loans. What is an FHA Loan? FHA loans are guaranteed by the U.S. Federal Housing Administration (i.e., the FHA). This guarantee reduces the risk lenders face when issuing loans, thus allowing lenders to lower their qualification criteria.