Contents

The two types of reverse mortgage interest rates. Reverse mortgage interest rates can be fixed or adjustable. The type of interest rate you choose determines your payout options. Of course, each rate type and payout option has pros and cons. fixed-rate reverse mortgages offer the borrower a lump sum of cash and predictable interest rates.

Fha Reverse Mortgage Rules FHA Reverse Mortgage loan counseling rules – FHANewsBlog.com – FHA Reverse Mortgage Loan Counseling Rules FHA Reverse Mortgages, also known as Home Equity Conversion Mortgages, have unique requirements because of the nature of the loan. HECM loans, which are intended for seniors age 62 and older, require no mortgage payments during the lifetime of the loan.

Tracker mortgage rates fall as competition increases – The average rate on two-year variable tracker mortgages has fallen steadily. the average two-year fixed mortgage rate at 60 per cent LTV is 1.90 per cent – 0.18 per cent higher than its variable. Best Rated Reverse Mortgage Lenders TALC is the main disclosure form for a reverse mortgage.

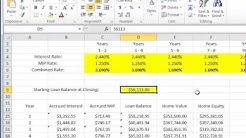

Let’s say that a lender is offering you a fixed rate reverse mortgage at a rate of 4.2%. We also know that annual MIP will equal 0.5% of the loan balance. In this case, you would calculate the rate by adding the two together: 4.20% + 0.5% = 4.70%. To get the APR, the lender would need to disclose insurance and closing costs. Scenario 2: Adjustable

Best Rated Reverse Mortgage Companies The first step when working with reverse mortgage lenders, as with a traditional mortgage, is the application. Reverse mortgage lenders will ask potential borrowers to decide on a payment plan, which in most cases can include a credit line, monthly advances, or a combination of both. Use our guide to compare the best reverse mortgage lenders.Texas Reverse Mortgage Best Reverse Mortgage Companies As reverse mortgage lenders continue to roll out new marketing campaigns and the public’s awareness of the financial tool grows, companies are seeking star talent to join their team. Companies like.A reverse mortgage, also known as HECM (home equity conversion mortgage) loan, is a powerful and proven financial instrument that allows you to access the equity you’ve accumulated in your home. In the state of Texas, both spouses must be at least 62 years of age and live in their own home with considerable equity.

"The client is often best served with a fixed rate reverse mortgage rather than unnecessarily being exposed to interest rate risk,". "ARLO is the most sophisticated reverse mortgage consumer pricing engine currently available" -MarketWatch ARLO is the only calculator of its kind to offer you instant and accurate eligibility across 2019’s best reverse mortgages.

Best Mortgage Who Reverse The Rates Has – Caffeinemaps – Let’s say that a lender is offering you a fixed rate reverse mortgage at a rate of 4.2%. We also know that annual MIP will equal 0.5% of the loan balance. In this case, you would calculate the rate by adding the two together: 4.20% + 0.5% = 4.70%.

(Shop for the best mortgage rates.) Before taking out a reverse mortgage, you should thoroughly understand reverse mortgage disadvantages and. Michael G. Branson (CEO All Reverse Mortgage Inc. and moderator of ARLO) has 40 years of experience in the mortgage banking industry and has devoted the past 14 years to reverse mortgages exclusively.

Bankrate’s rate table compares today’s home mortgage & refinance rates. Compare lender APR’s and find ARM or fixed rate mortgages & more.

Bankrate’s rate table compares today’s home mortgage & refinance rates. Compare lender APR’s and find ARM or fixed rate mortgages & more.