Contents

Bids in the fed-funds market on Tuesday morning reached as high as 5. rate higher were related to shortages of funds for.

Bids in the fed-funds market on Tuesday morning reached as high as 5. rate higher were related to shortages of funds for.

Get personalized rates. Pros of 5 year fixed mortgage rates Lower interest. There is quite a bit to consider before deciding on a 5 year fixed mortgage refinance. The most appealing part of a 5 year refinance mortgage is the low interest rate. The difference could be 1 percent or more, which can really add up.

Compare 5 year fixed rate mortgages. Compare every mortgage with an interest rate that is fixed for 5 years. Fixing your mortgage interest rate means you can be sure of the cost of your repayments for the next five years.

Principality Building Society has reduced selected fixed residential and buy-to-let rates within its range. The reductions.

Current Prime Rate History What Is The Us Interest Rate Interest Rates chart history chartsrus .:. historical Charts of Interest .:. Gold. – HISTORICAL CHARTS. These charts will only be updated occasionally. They are put here for their historical content. Please note that I am a collector/collator of data. I am always looking for historical data to add to my database. If you have some comments or data you would like to share with me. Please feel free to email me here Please enjoy.Interest rate – Wikipedia – An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited or borrowed (called the principal sum).The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited or borrowed.Prime US REIT. negatively. 4. Historical portfolio average occupancy numbers for all the 11 properties over the last three.5 Year Refinance Mortgage Rates 30 Year Fixed Mortgage Rate Chase Best Mortgage Rates at JPMorgan Chase, US Bank. – Finance Post – The benchmark 30-year fixed-rate mortgage is offered by Chase with a rate as low as 3.625% and a 3.686% APR with 0.750 point. This is one of the lowest rates offered for a 30-year fixed loan among major lenders and it beats the national average rate of 3.79%. The shorter-term 15-year fixed mortgage is published at 3.000% with a 3.162% APR and 1.Current 10 Year Fixed Mortgage Rate Who chooses a 10-year mortgage rates? Data from the mortgage bankers association covering early 2016 says that fixed-rate loans for terms other than 30 or 15 years, primarily 20 or 10-year mortgage loans, represented 18 percent of all refinances (an increase of 57 percent from the previous year).The average 15-year fixed mortgage rate is 3.20 percent with an APR of 3.39 percent. The 5/1 adjustable-rate mortgage (ARM) rate is 3.84 percent with an APR of 6.92 percent.Fha Rates Today 30 Year Fixed This fixed rate mortgage is a home loan with an interest rate that remains the same throughout the 30 year term. At the end of the 30 year repayment period, the loan is fully amortized. This means that the total principal (the face value of the loan) has been paid off in full in multiple installments.

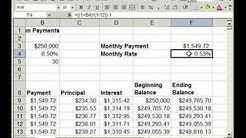

30 Year Fixed Rate Mortgage Amortization Example. The 30 year fixed rate mortgage tends to be the most popular type of home loan because it offers monthly payments that are predictable since the interest rate stays the same over the life of loan and more manageable since they are amortized over 30 years.

A fixed-rate mortgage gives you a special interest rate for a fixed period time, meaning your monthly repayments will stay the same until the fix ends. This calculator compares two fixed-rate deals. The length of fix and any fees complicate this – we break down the cost per month, over the fixed terms and until the mortgage is repaid.

This calculator helps you to determine what your adjustable mortgage payments. Adjustable rate mortgages can provide attractive interest rates, but your payment is not fixed. 5/1 ARM, Fixed for 60 months, adjusts annually for the remaining term of the loan.. The number of years over which you will repay this loan.

30 Year Fixed Fha Rates Lowest Current Mortgage Rates Bank of Oak Ridge mortgage rates are very low right now and beat most online mortgage rates today. 30 year mortgage rates at Bank of Oak Ridge are at 4.375 percent with 0.25 points and $853 in fees. 15 year mortgage rates from Bank of Oak Ridge are currently at 3.75 percent with no mortgage points and $853 in fees.Chicago, IL: $200,000, 20% down, 30 year fixed mortgage, All Points, Credit score 740+. Loans Above $417,000 May Have Different Loan Terms: If you are seeking a loan for more than $417,000, lenders in certain locations may be able to provide terms that are different from those shown in the table above.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. The Loan term is the period of time during which a loan must be repaid. For example, a 30-year fixed-rate loan has a term of 30 years. An Adjustable-rate mortgage (ARM) is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan, based on the.